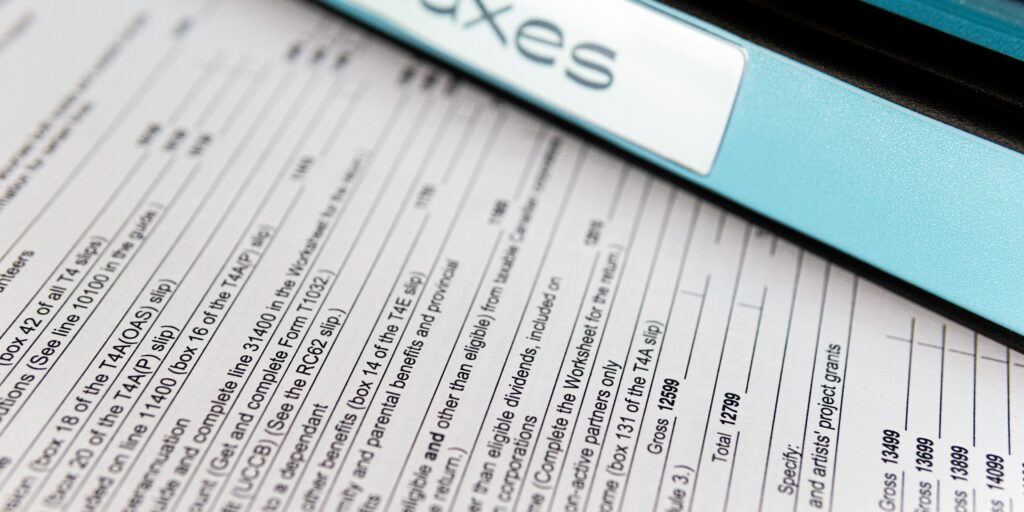

How to File Your Income Taxes in Canada: Tips and Important Information

Filing your income taxes is an important annual responsibility for individuals and businesses in Canada. This guide from Mesidor Immigration will provide you with an overview of the tax filing process, key deadlines, and helpful tips to ensure you complete your tax return accurately and efficiently.

Why You Need to File Taxes

- Legal Requirement: Most Canadians are required by law to file their income tax returns each year, even if they do not owe any taxes.

- Access to Benefits: Filing your taxes can qualify you for various government benefits and credits, such as the Canada Child Benefit (CCB) and the Goods and Services Tax/Harmonized Sales Tax (GST/HST) credit.

- Refunds: If you overpaid your taxes throughout the year, filing your return may result in a tax refund.

- Build Credit History: Filing your taxes helps establish your financial history, which can be beneficial for loans and credit applications.

Steps to File Your Income Taxes

1. Gather Necessary Documents

Before you begin the filing process, collect all relevant documents, including:

- T4 Slips: These slips report your employment income and deductions.

- T5 Slips: If you earned investment income, you’ll need these slips.

- Receipts: Gather receipts for deductible expenses, such as medical expenses, charitable donations, and business expenses if self-employed.

- Other Income Statements: Include any other income sources, such as rental income or capital gains.

2. Determine Your Filing Method

You can choose from several methods to file your income taxes:

- Online: Use certified tax software to file your taxes electronically. This method is convenient and often allows for faster processing and refunds.

- Paper Filing: You can also complete a paper tax return form and mail it to the Canada Revenue Agency (CRA). Download forms from the CRA website or request them by phone.

- Hire a Professional: If your tax situation is complex, consider hiring a tax professional or accountant to assist you.

3. Choose the Right Tax Form

Depending on your situation, select the appropriate tax form:

- T1 General: For most individual taxpayers.

- T2: For corporations.

- T3: For trusts.

4. Complete Your Tax Return

Fill out your chosen tax form, ensuring you provide accurate information. Key sections to complete include:

- Personal Information: Name, address, and Social Insurance Number (SIN).

- Income Reporting: Report all sources of income, including employment, investment, and self-employment income.

- Deductions and Credits: Claim eligible deductions and tax credits to reduce your taxable income.

5. Review Your Return

Before submitting, carefully review your tax return for accuracy. Check for:

- Mathematical errors

- Missing information

- Incorrect Social Insurance Number

6. Submit Your Tax Return

- Online: If filing electronically, follow the software prompts to submit your return directly to the CRA.

- Mail: If filing by paper, ensure you send your return to the correct address, which can be found on the CRA website.

7. Keep Records

After filing, retain copies of your tax return and all supporting documents for at least six years. This is important in case the CRA requests additional information or conducts an audit.

Key Deadlines

- April 30: The deadline for most individual taxpayers to file their income tax returns for the previous calendar year. If April 30 falls on a weekend, the deadline is extended to the next business day.

- June 15: If you or your spouse/common-law partner is self-employed, you have until June 15 to file your return. However, any taxes owed are still due by April 30.

- Payment Deadline: If you owe taxes, ensure payment is made by April 30 to avoid interest and penalties.

Tips for Filing Your Taxes

- Use Tax Software: Consider using CRA-certified tax software, which can simplify the filing process and help you maximize deductions and credits.

- Stay Informed: Keep up-to-date with changes in tax laws, as they can affect your filing and eligibility for benefits.

- Seek Help if Needed: If you have questions or uncertainties, don’t hesitate to reach out to the CRA or consult a tax professional.

Conclusion

Filing your income taxes in Canada is a crucial process that requires careful preparation and attention to detail. By following these steps and utilizing available resources, you can ensure that your tax return is filed accurately and on time. Remember, staying organized throughout the year will make the tax filing process much smoother. Good luck! If you need any assistance in this matter contact Mesidor Immigration.

Sharing is caring.

Share this information within your social circles.

Reach Out to Us if You Need Assistance with Your Settlement in Canada.

- EMAIL: im*********@*****or.ca

- PHONE / WHATSAPP: 204-898-8510

Search the Site

Latest Immigration News

- The Strong Borders Act: What Immigrants and Asylum Seekers Need to Know

- A Wave of Canadian Immigration Changes: What You Need to Know in June 2025

- PSTQ Québec 2025 : Votre Guide Essentiel du Programme de Sélection des Travailleurs Qualifiés

- June 5, 2025: Urgent! 4 Key Canadian Immigration Highlights & Updates

- Ontario Draws, Express Entry Buzz & New Asylum Rules – Your In-Depth Latest Canadian Immigration News for June 4, 2025

- Ontario Draws, Express Entry Buzz & New Asylum Rules – Your In-Depth Latest Canadian Immigration News for June 4, 2025.

- Navigating Express Entry, PNP Draws, Rural Pathways, and Economic Shifts for Aspiring Newcomers

- Decoding the Shifting Canadian Immigration Landscape: 4 Crucial Updates You Need to Know!

Subscribe to our Newsletter

Subscribe to our blog and get notified when we publish new posts.

Recent Comments